Jewelers Mutual Overview

Jewelers Mutual Group is a specialized insurance provider focusing exclusively on jewelry-related coverage. Established in 1913, the company offers comprehensive insurance solutions for both individual jewelry owners and businesses within the jewelry industry. With over a century of expertise, Jewelers Mutual is dedicated to safeguarding valuable pieces and supporting the jewelry community.

Company Background

Founded in Neenah, Wisconsin, Jewelers Mutual has grown to become a leading name in jewelry insurance. The company’s mission is to provide unparalleled protection and peace of mind to jewelry owners and professionals. Over the years, Jewelers Mutual has expanded its services beyond insurance, offering educational resources and risk management solutions to the jewelry industry.

Product Range

Personal Jewelry Insurance: Coverage for individual pieces such as engagement rings, watches, necklaces, bracelets, earrings, pearls, and brooches.

Business Insurance: Comprehensive policies for jewelry retailers, wholesalers, manufacturers, and designers, including coverage for inventory, equipment, and liability.

Metals Used

- Gold (14K, 18K, 22K, and 24K)

- Platinum

- Silver (Sterling Silver, Fine Silver)

- Palladium

- Titanium

- Stainless Steel These metals are commonly used in rings, necklaces, bracelets, and other jewelry types, and their coverage under Jewelers Mutual insurance would depend on the value of the item being insured.

Stones Used

- Diamonds (natural and lab-grown)

- Sapphires

- Emeralds

- Rubies

- Topaz

- Opals

- Garnets

- Amethyst The insurance typically covers any type of gemstone that is set into the jewelry and would be protected against damage, loss, or theft, depending on the coverage you choose.

Price Range

The price range for insuring jewelry with Jewelers Mutual varies significantly based on the value of the jewelry you wish to cover. For example, insuring a piece of jewelry worth $1,000 may cost between $10 and $20 per year. As the value of the jewelry increases, so do the premiums. A $5,000 engagement ring could cost approximately $50 to $100 annually, while a higher-value piece, such as an $8,000 necklace, might cost around $80 to $160 per year to insure. The premium is generally calculated as a percentage of the jewelry’s value, typically ranging from 1% to 2% annually.

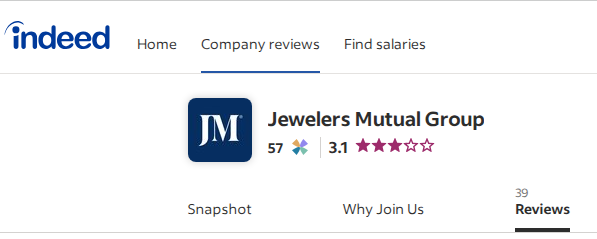

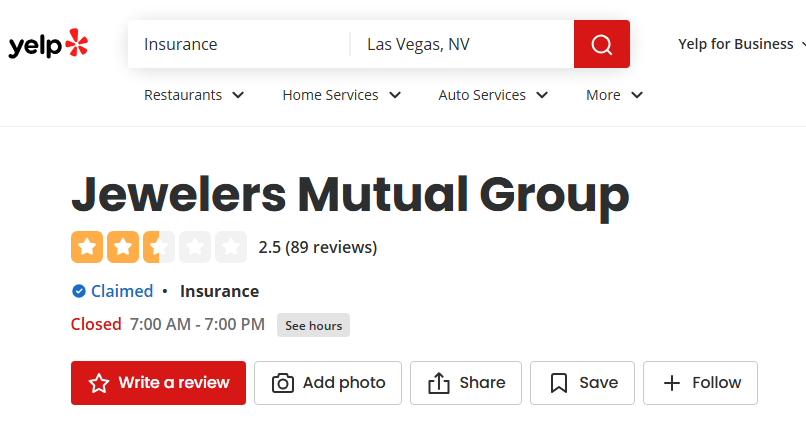

Jewelers Mutual Customer Reviews Across Platforms

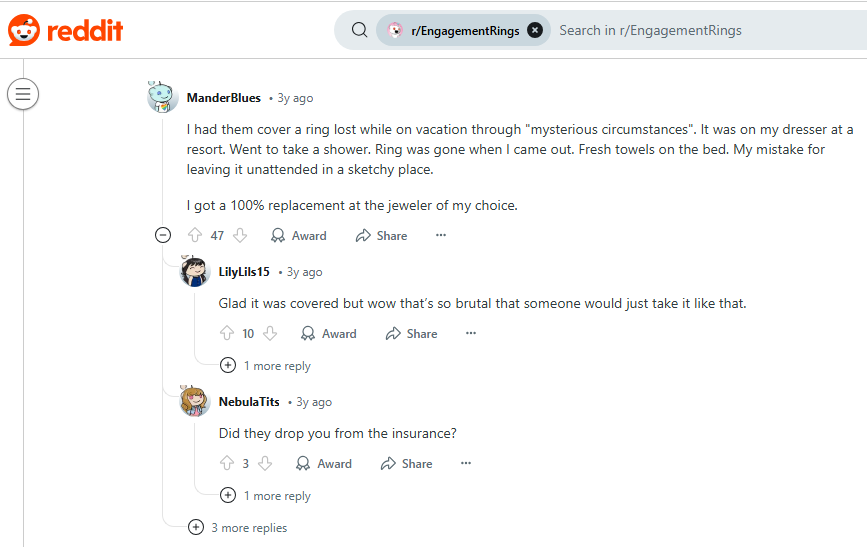

Redditors generally praise Jewelers Mutual for its stylish, affordable designs and good customer service, though some raise concerns about the durability of its gold-plated pieces for daily wear.

Customer's Feedback Summary

Pros:

- Reliable & Trustworthy Insurance Provider – Many long-term customers express satisfaction with coverage and claims processing.

- Hassle-Free Claims Process – Customers highlight easy and smooth claim approvals, even for high-value items.

- Excellent Customer Service – Many reviewers praise friendly and helpful representatives who address concerns quickly.

- Competitive Rates – Several users mention that Jewelers Mutual offers better pricing compared to homeowners insurance policies.

- Seamless Online Process – Some customers appreciate the ease of obtaining quotes, adding jewelry, and managing policies online.

- Trusted by Jewelers – Many jewelers recommend Jewelers Mutual as a preferred insurance provider.

Cons:

- Website & Account Setup Issues – A few customers struggled with creating accounts, resetting passwords, or navigating the site.

- Delayed Communication for Some Users – A couple of reviewers experienced slow responses to emails or inquiries.

- Payment Before Itemization – One reviewer mentioned that they were asked to pay before receiving an itemized list of charges.

- Rare Negative Customer Support Experiences – While most praise the customer service, one reviewer felt dissatisfied with their assistance.

We give It 4.5 Stars out of 5 in Cross Platform Reviews.

Note: You should must consider a fact that mostly frustrated comes to review a company on these platforms and in most of the cases happy customers don’t bother to rate. But these datas and reviews can give you a estimate about the service and product of the company.

Jewelers Mutual Social Media & Contacts

We give It 3.6 Stars out of 5 in Social Media Presence & Engagement

Note: All of their social handles are pretty active and engaging. This is a green flag for a jewelry Buyers.

Pricing & Value for Money

Pricing

To give you a clearer picture, here are some pricing examples based on specific jewelry values: A $5,000 engagement ring in Dallas may cost about $124 per year to insure, with a $0 deductible. Meanwhile, the same $5,000 engagement ring in Seattle could cost closer to $42 annually, due to varying risk factors like location. This illustrates how location, in addition to the value of the jewelry, influences the premium cost. It’s important to note that the deductible amount you choose can also affect the premium—opting for a higher deductible generally results in a lower premium.

Value For Money

Jewelers Mutual is highly regarded for its specialized coverage and customer service. The company boasts over 12,000 five-star reviews, reflecting customer satisfaction with their comprehensive policies and claims process. Additionally, Jewelers Mutual has maintained an A+ Superior financial rating from AM Best for 37 consecutive years, indicating strong financial stability.

Discount Coupons and Promotions

Home Security Systems: Having a monitored home security system.

Gemprint Identification: Inscribing jewelry with a unique Gemprint ID.

We give It 3.5 Stars out of 5 in Price and Value analysis.

Frequently Asked Questions About Jewelers Mutual

1. What types of jewelry does Jewelers Mutual insure?

They cover a wide range of jewelry, including engagement rings, watches, necklaces, bracelets, earrings, pearls, and brooches.

2. How is the premium for jewelry insurance calculated?

Premiums are typically 1-2% of the jewelry’s value annually, influenced by factors like location, item value, and chosen deductible.

3. Does the policy cover accidental loss?

Yes, their policies cover accidental loss, theft, damage, and mysterious disappearance.

4. Can I insure multiple pieces under a single policy?

Yes, multiple items can be covered under one policy, with each piece individually listed and appraised.

5. How do I file a claim?

Claims can be filed online through their website or by contacting their customer service directly.

6. Is there coverage for jewelry while traveling internationally?

Yes, their policies provide worldwide coverage, ensuring your jewelry is protected wherever you go.

7. Are there any deductible options?

Yes, various deductible options are available, allowing customization of the policy to fit your needs.

8. How is the value of my jewelry determined for insurance purposes?

An appraisal from a qualified jeweler is used to establish the item’s value.

9. Does the policy cover routine maintenance?

Routine maintenance is generally not covered; the policy focuses on loss, theft, and damage.

10. How can I get a quote for insuring my jewelry?

Quotes can be obtained by visiting their official website and providing details about your jewelry.

Conclusion

Jewelers Mutual is a reputable jewelry insurance company with extensive cover and good reputation in the market. Customer reviews on platforms such as Trustpilot, Better Business Bureau (BBB), and Reddit tend to be overwhelmingly positive, with users praising the simplicity of coverage acquisition, affordability, and no-fuss claims procedure. Most policyholders also praise the company’s commitment to customer care and rapid settlement for lost, stolen, or broken jewelry. However, some users have reported issues with claims approvals taking longer than expected and occasional difficulties in communication.

On pricing, Jewelers Mutual is fairly priced by the value of the item, the location, and the risk. Although there are customers who rate the prices as fair and competitive with traditional insurers, there are others who complain that the premium could be cheaper, particularly for valuable items. Nevertheless, the comprehensive coverages, including protection globally, make the expense justified for many.

Customer service commentary is generally positive, with the representatives being reported as knowledgeable and prompt. Delays in claims processing or a struggle to get exact answers on policy specifics have been experienced by some customers, though. Transparent policies and straightforward documentation by the company reduce confusion, but infrequent miscommunication has been observed.

Jewelers Mutual has a business-like social media presence with educational material on jewelry care, insurance covers, and customer testimonials. The activity is lower than that of jewelry shops, yet the brand is able to establish trust by posting informative information and chatting with customers. Discounts and promotions are not one of their primary concerns because the business specializes in insurance and not tangible goods.

At JewellersReviews, we post objective, in-depth reviews of companies such as Jewelers Mutual to assist consumers and jewelry owners in making better choices. If you are thinking of insuring an expensive item or want to know about pricing, claims handling, and customer care, our reviews contain all the pertinent information. Check our site to read more jewelry-related company reviews and choose the most suitable ones for yourself.

We give It 3.9 Stars out of 5 as Overall Ratings.

Have you ever tried Jewelers Mutual? We would love to hear your experiences or answer any questions you may have in the comments below. Let’s share our thoughts with others so they can be better informed!

I am Satyam Pandey, a gemologist with a Diploma in Polished Diamond Grading from KGK Academy, Jaipur. I love writing about jewelry, gems, and diamonds, and I share simple, honest reviews and easy buying tips on JewellersReviews.com to help you choose pieces you’ll love with confidence.